Amidst rising economic uncertainty marked by high interest rates, record-breaking inflation, and a prolonged recession spanning nearly 15 months, the imperative for financial stability intensifies. Federal Reserve chair Jerome Powell’s recent update on Tuesday, April 16, revealed that inflation remains stubbornly high, delaying anticipated interest rate cuts. This development adds another layer of unpredictability to an already volatile economic landscape. However, amidst this turbulence, solar power emerges as a reliable ally, offering environmental benefits and financial resilience against market fluctuations. In this article, we explore why embracing solar energy is not only a sustainable choice but also a strategic safeguard for your finances in an uncertain economy with no immediate signs of improvement.

The Current Economic Maze

Since 2020, the global economy has experienced a rollercoaster ride of fluctuations and uncertainties, making the analogy of today’s economic climate to a maze particularly fitting. Notably, for a record-breaking 446 days (as of Monday, April 15), the Fed’s recession indicator has signaled an impending downturn that has yet to actually occur (3). While it is undoubtedly favorable that the United States has managed to steer clear of a recession thus far, it’s important to understand that we are still far from a full recovery. It may take considerable time before our economy regains its footing and returns to stability.

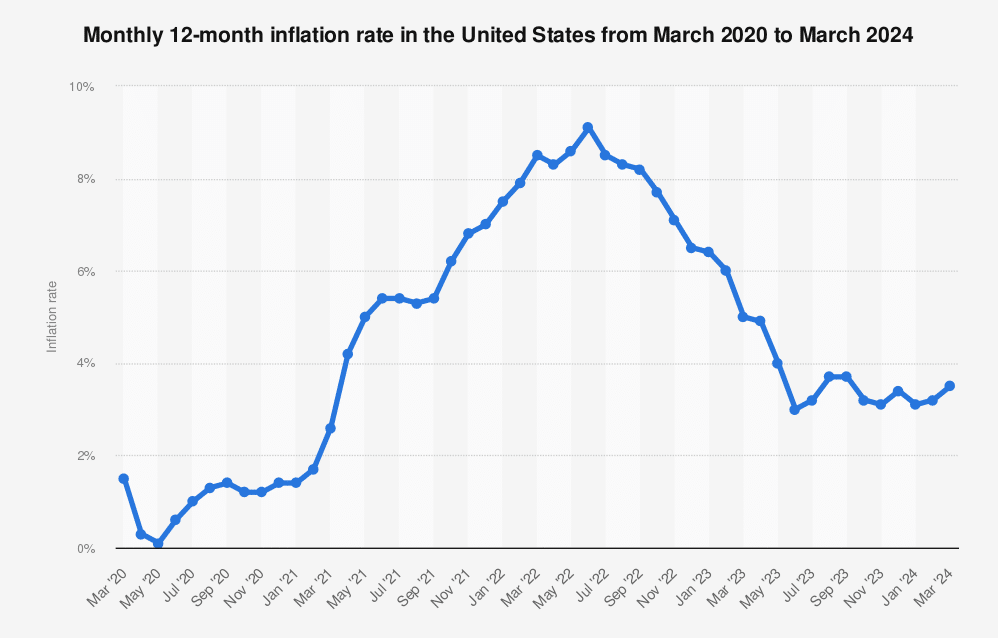

In Powell’s recent statement, he acknowledged a slight decrease in inflation, though not at a pace significant enough to warrant an adjustment in interest rates. March’s consumer price index (CPI) reading revealed inflation running at a 3.5% annual rate, notably lower than the peak of 9% observed in mid-2022. However, this 3.5% figure represents a steady climb since October 2023 and still marginally exceeds the Fed’s target inflation rate of 2% (1). Shown at right, we can see inflation rates have gotten better in the last 24 months, but comparatively to the previous 48 months, there is still a lot more work to be done.

Likewise, from the standpoint of interest rates, the forecast appears grim. Since July 2023, the Federal Reserve has maintained its benchmark interest rate within a target range of 5.25% to 5.5%, marking the highest rates seen in 23 years. This marks the continuation of 11 consecutive rate hikes initiated in March 2022. Consequently, leading financial analysts at firms such as Goldman Sachs and JP Morgan are predicting the possibility of a first rate cut in July (2). However, the ultimate decision rests with Powell and the Federal Reserve.

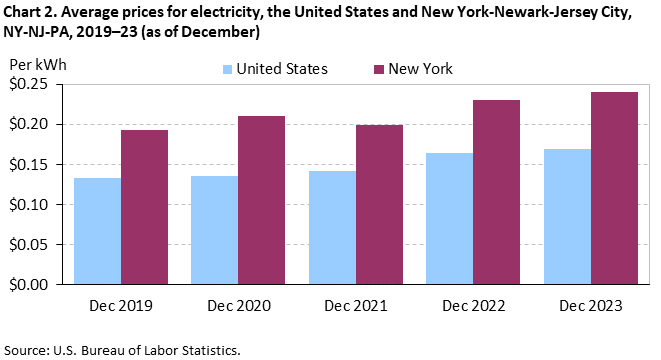

If inflation and interest rate hikes haven’t been enough, the Bureau of Labor Statistics found that electricity prices rose 5% over the past year on a nationwide average (4). This far outpaces the CPI of 3.5% and is higher than any other single commodity, including food (2.2%) and gasoline (1.3%). The harsh reality is- it costs more to live than it used to, and Americans need options to alleviate this financial burden.

As interest rates remain stagnant and inflation persists above target levels, Americans face heightened financial pressure. With the Federal Reserve signaling a cautious approach to rate cuts and economic uncertainty prevailing, protecting our wallets has become an urgent priority. Now more than ever, exploring strategies such as embracing solar energy to mitigate financial risks and safeguard against economic fluctuations is crucial for individuals seeking stability in an unpredictable landscape.

Solar's Role in Economic Stability

In the current economic climate marked by high interest rates and inflationary pressures, solar panels present a compelling solution for financial resilience. With New York State Energy Research and Development Authority (NYSERDA) rebates set to expire, there’s a sense of urgency to capitalize on available incentives. Eligible homeowners stand to benefit significantly, as they can receive approximately 50% of the total project cost as a tax credit, substantially reducing the financial burden of solar panel installation. Beyond immediate cost savings, investing in solar offers a long-term strategy for mitigating energy expenses and enhancing financial security. By generating clean, renewable energy, individuals not only insulate themselves from rising utility costs but also contribute to a sustainable future. In these uncertain times, leveraging solar incentives and rebates not only strengthens financial resilience but also aligns with environmental stewardship, providing a practical and impactful way to navigate economic challenges.

As New York’s premier choice for solar solutions, Kasselman Solar stands at the forefront of the renewable energy revolution. With deep roots as a local installer and an impressive 75 years of industry experience, we have been serving the community with dedication and expertise since 2014, marking a decade of commitment to excellence in 2024. Recognized as a five-time NYSERDA Quality Solar Installer and featured in reputable publications like Forbes, our track record speaks volumes about our reliability and innovation. As we continue to lead the charge towards a sustainable future, homeowners and businesses can trust Kasselman Solar to deliver cutting-edge technology, exceptional service, and unmatched expertise, empowering them to thrive in today’s dynamic energy landscape.

- https://www.cnbc.com/2024/04/16/powell-cites-lack-of-progress-this-year-in-reaching-feds-inflation-goal.html

- https://www.cnn.com/2024/04/16/business/chair-powell-discussion/index.html

- https://www.marketwatch.com/story/for-a-record-446-days-this-recession-indicator-pointed-to-a-downturn-that-never-arrived-d907e018

- https://www.eenews.net/articles/electricity-prices-rise-faster-than-inflation/#:~:text=The%20Bureau%20of%20Labor%20Statistics,and%20gasoline%20(1.3%20percent