In many ways, it’s the million dollar question: how do solar tax credits work?

Sure, you may have heard about how federal and state tax credits can save you about half of the total project cost on your solar installation. But, when tax season rolls around, how do you actually apply your solar tax credits on your annual return? First, let’s establish the difference between a solar tax credit and a solar rebate. We want to make this difference very clear, as our mission is for our clients to be fully educated about which financial incentives they qualify for to prevent any unwelcome surprises.

A tax credit for solar reduces the amount of income tax you owe to the government dollar-for-dollar, based on a percentage of your solar system’s cost. If you install a solar system and qualify for a tax credit, you subtract this credit directly from your total tax liability, not from your taxable income.

On the other hand, a rebate is a partial refund after the purchase of your solar system, often provided by state governments, utilities, or manufacturers. Unlike a tax credit, a rebate gives you a specific amount of money back, directly reducing the initial cost of your solar installation, regardless of your tax situation (for example, the NYSERDA rebate).

Taxes Explained

Disclaimer: Kasselman Solar is not an accounting firm, and is not authorized to provide tax advice. As always, you should consult with your tax professional regarding your own individual eligibility. This article simply a guide with general information about solar tax credits.

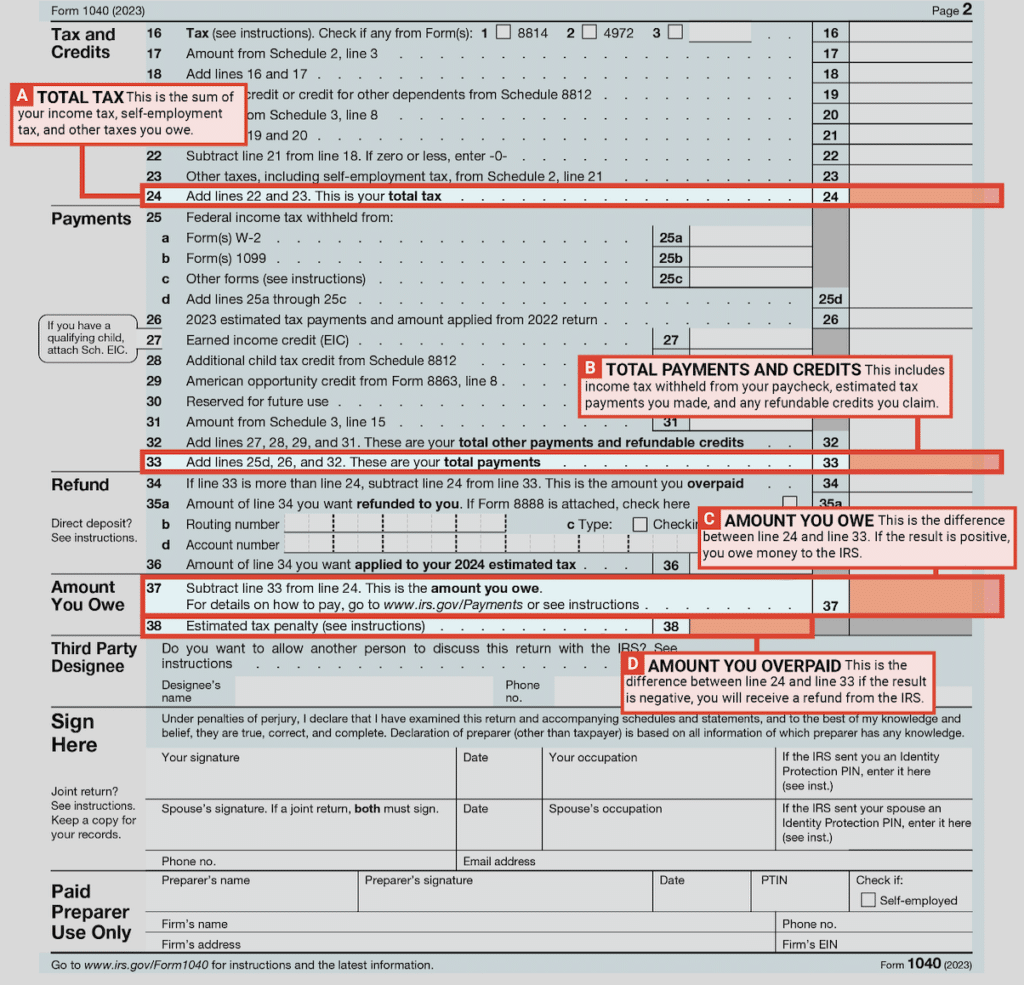

Before we dive into how solar tax credits work, let us lay the foundation and explain the basics. Knowing this information can help you file taxes quicker, easier, and help make sense of your finances across all fronts. In short, your tax refund is calculated by taking your total withholdings and credits minus your total tax liability. Looking at the boxes in the image on the right (Form 1040), it is Box A minus Box B equals Box C.

Total Payments and Credits (Withholdings)

Total payments and credits is the basis for your annual tax return, as this is the total amount withheld from your paycheck. Most individuals receive regular paychecks with a paystub. On your paystub, you will see a section for withholdings, which are various taxes/contributions taken directly out of your paycheck, such as for federal taxes, state taxes, and Social Security contributions.

Tax Liability (Total Tax)

Tax liability is what you owe the government from income tax, capital gains tax, self-employment tax, and any penalties or interest. To find out your tax liability, we take your gross income on the year and subtract any appropriate deductions (401k contributions, claiming dependents, charitable donations, etc). This gives us your adjusted gross income, which is used to calculate your total tax liability. At the end of the year, you will have a total tax paid, which can be found on Form 1040 for your federal return and Form IT-201 for your NYS return.

Where To Find Tax Liability Information

While this can definitely feel like an overload of information, it’s truly very simple. All of the information you need can be found right on your tax forms!

On Federal Tax Return

(Form 1040):

- Line 24: Total tax. This is the sum of your income tax, self-employment tax, and other taxes you owe, also known as your tax liability.

- Line 33: Total payments and credits. This includes income tax withheld from your paycheck, estimated tax payments you made, and any refundable credits you claim.

- Line 37: Amount you owe. This is the difference between line 24 and line 33. If the result is positive, you owe money to the IRS. This means you didn’t have enough money withheld from your paycheck to receive a return.

- Line 38: Amount you overpaid. This is the difference between line 24 and line 33. If the result is negative, you will receive a refund from the IRS because you had more taken out of your paycheck than what you actually owed.

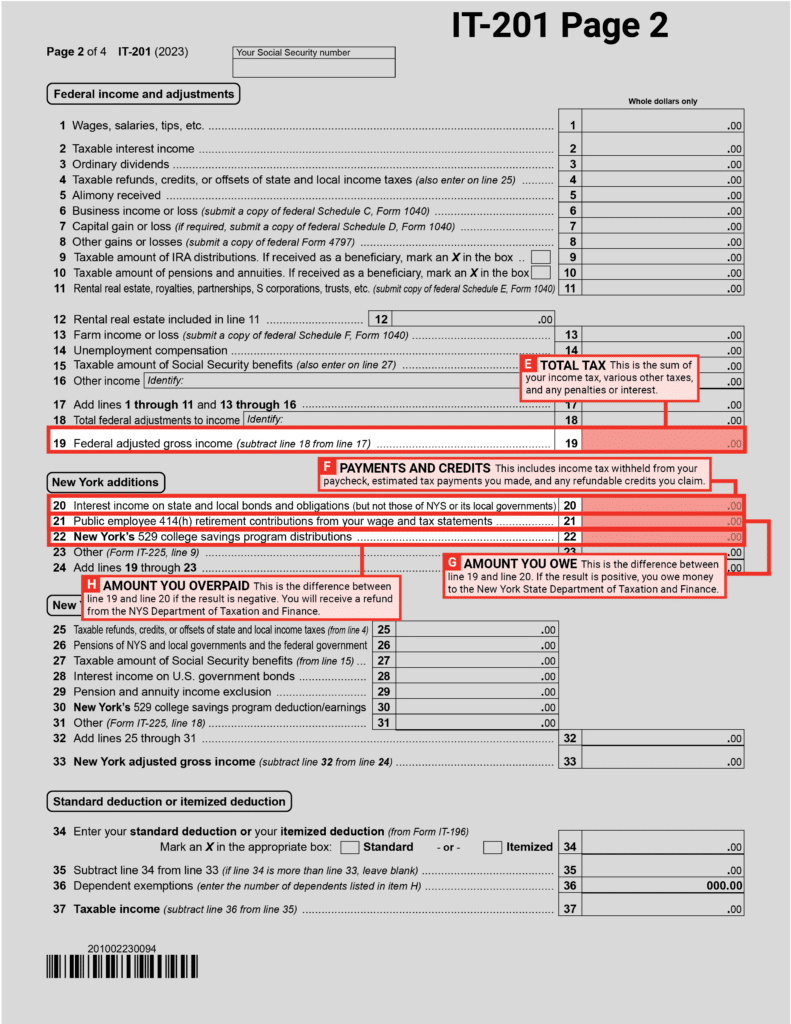

On New York State Tax Return

(Form IT-201):

- Line 19: Total tax. This is the sum of your income tax, various other taxes, and any penalties or interest, also known as your tax liability.

- Line 20: Payments and credits. This includes income tax withheld from your paycheck, estimated tax payments you made, and any refundable credits you claim.

- Line 21: Amount you owe. This is the difference between line 19 and line 20. If the result is positive, you owe money to the New York State Department of Taxation and Finance. This means you didn’t have enough money withheld from your paycheck to receive a return.

- Line 22: Amount you overpaid. This is the difference between line 19 and line 20 if the result is negative. You will receive a refund from the NYS Department of Taxation and Finance because you had more taken out of your paycheck than what you actually owed.

How Solar Tax Credits Are Applied

In summary, solar tax credits are deducted from your tax liability. To give a real-world example, let’s say you paid $10,000 in withholdings over the year and have a $9,000 total tax liability.

Scenario 1: No Solar

- You have a $10,000 in paycheck withholdings.

- Your total tax liability is $9,000.

- There’s a $1,000 excess, so your refund would be equal to $1,000.

Scenario 2: With Solar

Continuing this example, let’s add in the element of your federal/state solar tax credits adding up to $5,000:

- You have $10,000 in paycheck withholdings.

- Your total tax liability is $9,000.

- The tax credits for your solar array are equal to $5,000.

- This now makes your tax liability $4,000 (calculation is your tax liability less solar tax credits).

- So, to calculate your return, subtract your tax liability from your withholdings ($10,000 less $4,000) to equal your refund of $6,000.

But, what if your tax credits exceed your tax liability?

Depending on the year your solar system was placed in service, you can carry over the unused credit.

- Federal Carry Over Period: Projects placed in service in 2023 or later: You can carry forward the unused credit for 22 years.

- Projects placed in service before 2023: The federal carry over period is 20 years.

- The New York State carry over period is 5 years.

The Bottom Line

While it may seem complicated at first, solar tax credits can be very easy to claim if you simply know how the system works. The benefits of solar are manifold- helping the planet, adding value to your home, decreasing/eliminating your utility bill, and even receiving extra thousands of dollars back on your annual tax return.

As we’ve navigated through the ins and outs of solar tax credits, it’s clear that the path to a sustainable future is illuminated by the benefits of solar energy. From significant savings on energy bills to a reduced carbon footprint, the advantages of making the switch to solar are both immediate and impactful. With a decade of dedicated service, Kasselman Solar stands as a beacon of excellence in the solar industry. Our recognition as a 5-time NYSERDA Quality Solar Installer is not just a badge of honor but a testament to our commitment to providing top-tier solar solutions. As you consider the leap into solar energy, remember that with Kasselman Solar, you’re choosing a partner with a proven track record of quality, reliability, and a deep-rooted passion for paving the way to a greener planet.

Disclaimer: Kasselman Solar is not an accounting firm, and is not authorized to provide tax advice. As always, you should consult with your tax professional regarding your own individual eligibility. This article simply a guide with general information about solar tax credits.