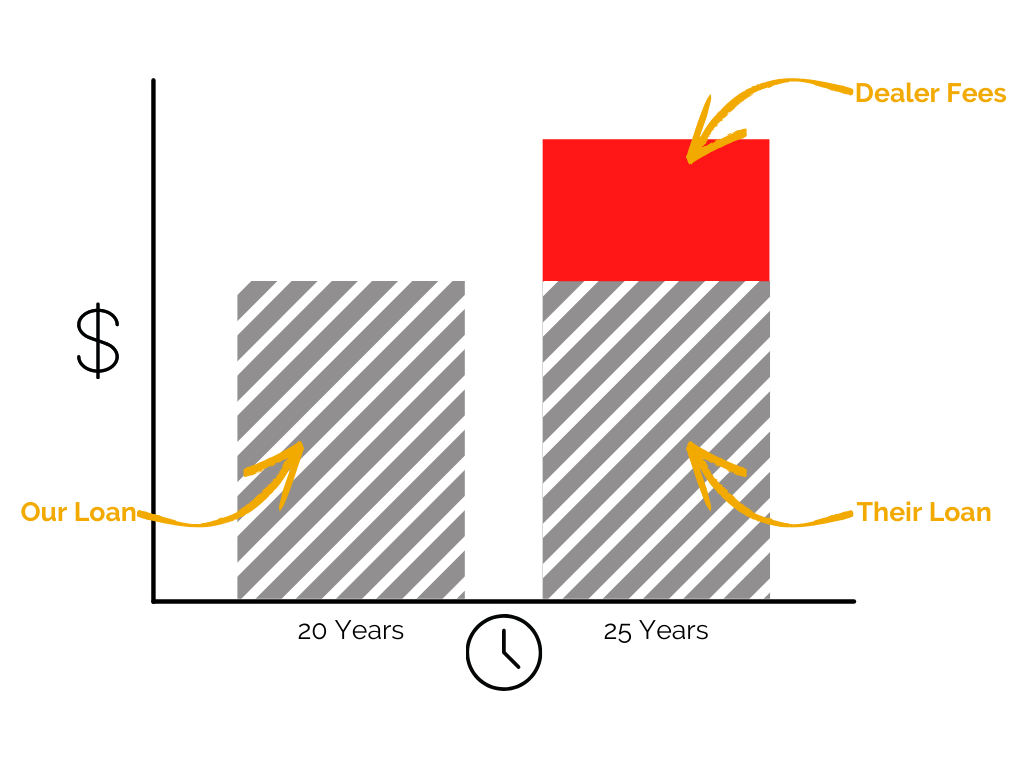

Dealer fees are a percentage of a projects cost added onto the initial loan amount to lower the loans APR. They can be as high as 25% of a projects’ cost. A few hours worth of time to apply for a legitimate loan can save literally thousands of dollars.

Many solar clients seek financing with their solar projects due to the sheer size of these projects. Many, when investigating, are being solicited with what appears to be extremely low interest-rate loans with exceptionally low payments. Some of these loans being as low as .99% for 25 years. Sounds great, doesn’t it?

But there is a catch-all caveat called “dealer fees.” These fees are boasted as a one-stop solution for solar financing. Dealer fees are disguised as an investment with a low monthly payment, but actually are more expensive than traditional loans. Knowing how to recognize a treacherous loan can help you avoid getting tricked by a dishonest company.

A Solar Dealer Fee is a percentage of the loan added onto the total principal of the loan. It typically falls between 15 to 25% of the project’s cost and gets added to the loan principal.

The idea is to reduce the Annual Percentage Rate (APR) to make the loan seem more appealing compared to standard solar loans. This is very similar to paying points on a mortgage, something that was done a lot during the mortgage boom of the early 2000s.

For example, if you take out a $30,000 loan, the dealer fees could add an extra $7,500 to the total- making it a $37,500 loan!

These loans often come with lower APRs and monthly payments, which could sound great at first glance. But there is a catch: they often stretch out the repayment period and increase the total cost over time.

So, while it might seem like a better deal upfront, you’ll likely end up paying more in the long run.

Here's How to Avoid Dealer Fees:

Some solar lenders and financiers often justify enormous dealer fees with misleading claims like “it’s the only way to go solar” or “it’s the industry standard”, but none of that is true. In fact, getting approved for a solar loan through a private lender or credit union can take as little as two to three hours! Here at Kasselman Solar, we are proud to use exclusively independent banks and credit unions to protect our customers from dangerous solar loans. As a customer, you deserve to be informed on what works best for you and your individual financial situation when going solar.

Dealer fee loans might seem easy with their quick online applications, but taking a couple of extra hours to provide income documentation for a credit union loan can save you thousands in the long run. Isn’t that worth it?

When you choose Kasselman Solar, you’ll get a dedicated Project Manager to guide you through every step of the financing process for your solar journey. We make it simple and transparent, so you can feel confident about your investment in solar energy. With over a decade of trusted service in New York State, we’re here to make your switch to solar a seamless and stress-free experience.

“Reputation Forged By Results. Relationships Built On Trust.”

Thinking of going solar with us?