In August of 2022, the Inflation Reduction Act was signed by President Biden. This act puts forward $370 billion towards lowering the cost of clean energy spending (2). This law works to increase people’s investment in clean energy. The law’s goal is to make it easier for families and small businesses to invest in more clean energy sources now by returning a portion of the cost as tax credit.

Increases to the Federal Solar Tax Credit

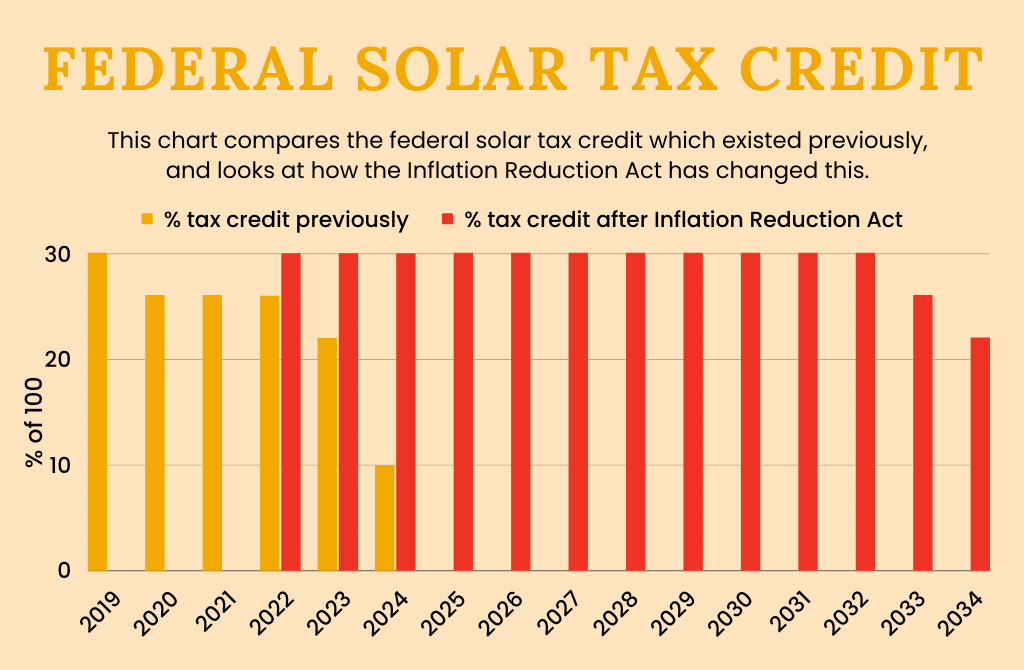

With the implementation of the Inflation Reduction Act, there has been an extension of the Investment Tax Credit (ITC).

This increases the federal solar tax credit to 30% through 2034 (3). This means that the homeowner or business owner can receive up to 30% of the cost of the solar installation back as tax credit at the end of the year that the installation was completed (4).

Prior to this extension of the ITC, this tax credit was set to decrease from the 26% credit in 2022 down to very little or nothing in 2024 (3). Now, with the extension the tax credit has been increased back to 30% all the way through 2034, providing long-term stability for financial incentives!

This refund of tax credits is subtracted from your federal income taxes at the end of the year of the installation (3).

Let's Look at the Math!

Homeowners and business owners can claim up to 30% of the cost of a solar project as a tax credit. This means that, for example, for a $20,000 solar project you could save up to $6,000! Plus, New York boasts the best solar incentives in America, so residential projects can also receive tax credits from the State Government and rebates from NYSERDA.

Continuing this example, if this $20,000 project was completed in the summer of 2023, the homeowner will gain this $6,000 tax credit on their next completed federal taxes. This means $6,000 will be subtracted from the amount owed by the homeowner. These tax credits from solar energy carry over as they are Residential Clean Energy Property Credit (6). Additionally, if your federal income taxes are less than your total tax credit, then your tax credit can rollover to the next year, so you can continue to enjoy savings!

How can the Inflation Reduction Act help my small business?

There are many ways that the Inflation Reduction Act (IRA) can help small businesses, including lowering energy costs. This law focuses on decreasing energy costs and combating the climate crisis. This historic change mutually helps the global climate crisis as well as individuals and businesses.

The Inflation Reduction Act covers a variety of energy saving processes. This includes improving insulation, switching to more energy-efficient appliances, installing solar energy, and more (5)!

This law also increased funding for other programs, such as the Rural Energy for America Program (1). This program provides more funding for rural and agricultural small businesses looking to go solar and move to clean energy.

Switching to solar energy can help save energy costs in the long run for small businesses. This allows you to have more money to put towards growing your business!

Save Money and Help the Planet

A major focus of this law is to help incentivize more homeowners and business owners to switch to cleaner energy now. Switching to clean energy, such as solar energy, has many benefits. This can help you save money, but it can also help you or your company reduce your carbon footprint.

The Inflation Reduction Act is projected to reduce greenhouse gas emissions by around 40% by 2030 when compared to levels in 2005. This will make great strides towards meeting the overall US’s climate goal of hitting a 50% decrease in 2030 (4).

By working with homeowners and business owners and creating a greater incentive to switch to clean energy. As a result of this law, the US can decrease pollution by non-renewable energy resources, increasing the use of clean energy and provide great savings in energy costs!

Go solar today! With great incentives and savings you can help the planet while lowering your energy bills!

- https://www.whitehouse.gov/briefing-room/statements-releases/2022/09/12/fact-sheet-how-the-inflation-reduction-act-will-help-small-businesses/

- https://www.whitehouse.gov/cleanenergy/inflation-reduction-act-guidebook/

- https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics#:~:text=Solar%20PV%20systems%20installed%20in,a%2030%25%20tax%20credit

- https://www.energy.gov/sites/default/files/2022-08/8.18%20InflationReductionAct_Factsheet_Final.pdf?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosgenerate&stream=top

- https://www.whitehouse.gov/wp-content/uploads/2022/12/Inflation-Reduction-Act-Guidebook.pdf

- https://www.irs.gov/pub/taxpros/fs-2022-40.pdf