In today’s world, harnessing renewable energy sources is not only an environmentally responsible choice, but a financially prudent one, especially with today’s many options for solar financing. Solar power, in particular, has gained immense popularity for its ability to reduce electricity bills while contributing to a sustainable future. However, the upfront costs associated with solar panel installation can deter many families and businesses from making the switch. Solar financing can be complicated, but that doesn’t have to equal stress and headaches for the customer. Thankfully, various financing options and programs are available to make going solar more accessible and affordable, especially in New York State.

NYSERDA's Green Jobs Green New York (GJGNY) Program

The New York State Energy Research and Development Authority (NYSERDA) plays a vital role in promoting clean energy initiatives across the state. One of its flagship programs, the GJGNY program, is designed to make solar energy accessible to New York families. GJGNY provides New Yorkers with access to energy assessments, installation services, and pathways to training for various green-collar careers.

In addition, one of the program’s standout features is its range of interest rates, which vary from 3.49% to 6.99%. This flexibility allows homeowners to select a financing option that aligns with their budget and financial goals. In fact, GJGNY loans are on par or even lower than the national average for solar loans, which, according to Forbes, ranges between 4-17% (1). See if you qualify here.

Affordable Solar for Underserved Communities

Recognizing the importance of inclusivity and equality in the transition to solar energy, New York has also introduced the Affordable Solar program. This initiative focuses on providing low-interest financing options specifically tailored for underserved households and communities.

To qualify for this program, individuals and neighborhoods must meet certain criteria, ensuring that those who need solar energy the most can access it without financial barriers. Currently, the Affordable Solar program is available for households earning less than 80% of the median income in their area (2).

Our Innovative Partnership with First New York Federal Credit Union

Kasselman Solar, as a leading solar energy provider in the Capital District and Hudson Valley, has taken a progressive approach to solar financing. We have partnered with the local First New York Federal Credit Union (FCU) to offer customized solar loans to our customers. What sets this partnership apart is our mutual commitment to tailoring financing options to each customer’s unique needs.

No two solar projects are the same, so there is no “one size fits all” financing solution. By working with First NY FCU, our goal is for our customers to receive financing that aligns with their goals and circumstances- and avoids the dangers of dealer fees. See if you qualify here.

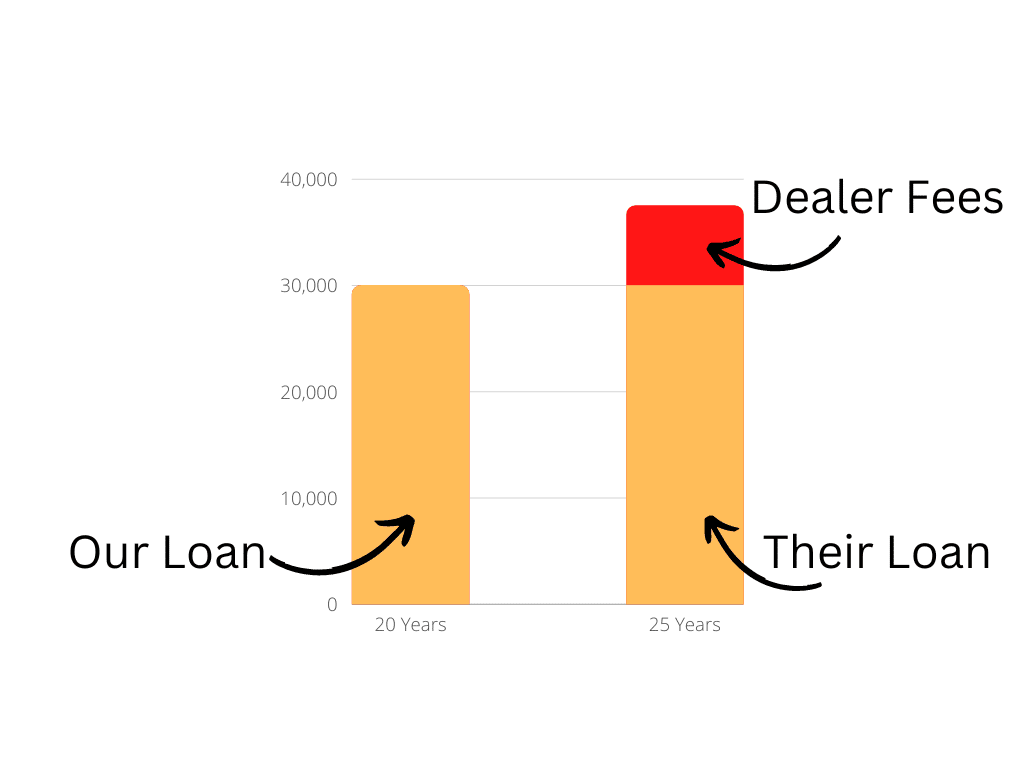

The Bottom Line: Avoiding Dealer Fees

While the solar industry presents various financing options, customers should exercise caution when exploring these choices. But, the dark side of solar financing is “dealer fees.” These fees are often unnecessary charges added to the principal amount of the loan. On the surface, loans with dealer fees look attractive due to their low monthly payment and low APR, but they come with longer payment periods and higher overall costs due to the dealer fees. Essentially, loans with dealer fees cost significantly more on this.

So, when considering solar financing, it’s crucial for homeowners to look at the fine print so they can avoid getting swindled into a dangerous loan. Transparent and honest financing, such as through GJGNY, Affordable Solar, and First NY FCU ensures your investment is protected from hidden fees.

Be an Informed Consumer

As the world strives to reduce its carbon footprint and transition to renewable energy sources, solar power stands out as a clean and sustainable option. Financing options like NYSERDA’s GJGNY program, the Affordable Solar program, and innovative partnerships with banks and credit unions help make the switch to solar more affordable and accessible for New Yorkers.

That said, it’s essential for consumers to remain vigilant when exploring financing options to avoid hidden fees that can inflate the overall cost- damaging your investment in the long run. By staying informed and choosing transparent financing solutions, individuals can harness the power of the Sun, while enjoying both environmental and financial benefits. Reach out to our team today, and learn how solar can work for you!