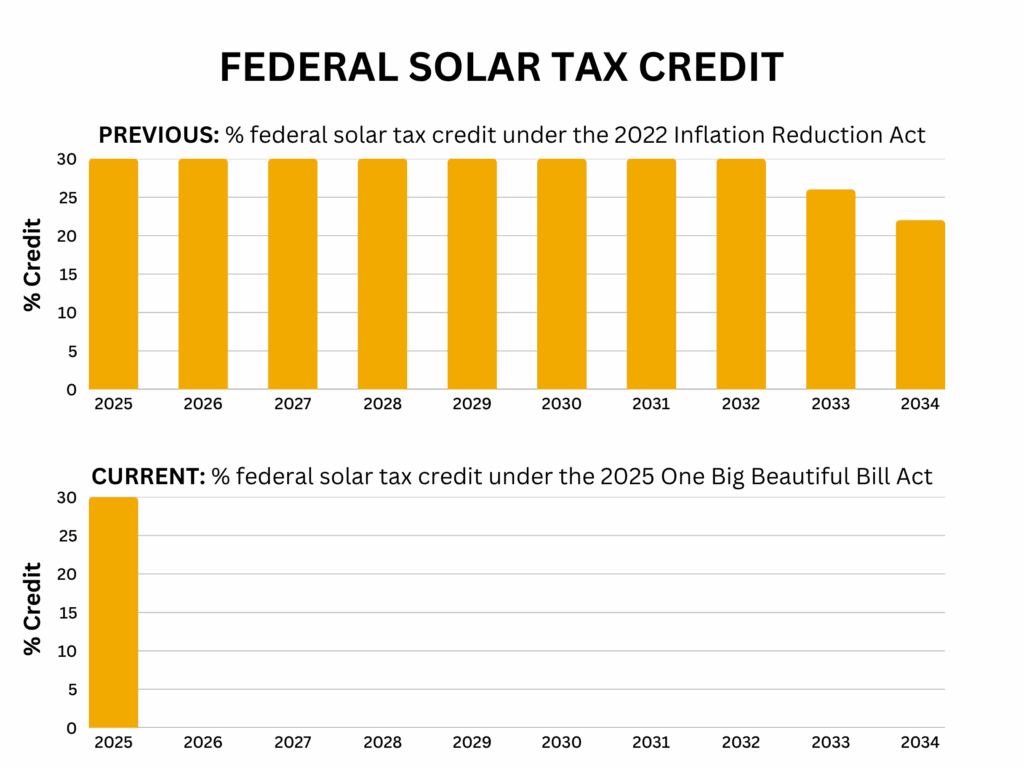

On July 4th, 2025, the One Big Beautiful Bill was signed into law – bringing with it sweeping changes to clean energy incentives, including a major shift for residential solar. Most important to solar, the bill ends the 30% Federal Solar Tax Credit for homeowners at the end of this year. This cuts the incentive nearly a decade early from its original phase-out under the Inflation Reduction Act.

2025 was already one of the best years to make the switch to solar, especially with rising utility costs, growing interest in energy independence, strong New York State solar incentives, and rebates on batteries and additional clean energy home upgrades. But this new deadline cements 2025 as the year to go solar.

If you’ve been thinking about solar, don’t wait – act now to secure your system, maximize your savings, and avoid paying thousands more in 2026 and beyond.

What is the One Big Beautiful Bill?

The One Big Beautiful Bill Act (OBBBA), passed on July 4th, 2o25, brings significant changes including direct changes to solar incentives for homeowners at the federal level (1). Specifically, this bill brings an early end to the 30% Federal tax credit for residential solar installations. This credit has helped millions of Americans go solar more affordably, and now will only be available through the end of this year. This is close to a full decade sooner than previously planned with the Inflation Reduction Act

Here we’ll break down what the bill means for the residential solar industry specifically, what changes are coming into next year, and why homeowners considering solar need to act as soon as possible before the end of 2025.

View the full bill changes.

The 30% Federal Solar Tax Credit Running Out

Original Incentives Available by IRA

The Federal government has offered a tax credit to help offset the upfront cost of installing solar for years. The credit was then extended and expanded under the 2022 Inflation Reduction Act (IRA), allowing homeowners to claim this federal income tax credit through 2034.

Under the IRA this incentive was previously set to remain at 30% through 2032 at which point it would drop to 26% in 2033 and 22% in 2034.

Changes Coming with the “Big Beautiful Bill”

- The 30% Federal residential solar tax credit (Section 25D) now fully ends after December 31, 2025.

- There is no longer a gradual phase-down to end this incentive.

- Homeowners who install solar panels on or after January 1, 2026 will no longer qualify for any Federal solar tax credits under this program.

What’s at Stake for Homeowners

With these recent changes, homeowners can still claim 30% of the cost of their solar system as a tax credit through the end of 2025. This means that for an example solar project, costing $30,000 in full, you could save up to $9,000 after the tax credit. That’s almost 1/3 of your project cost covered.

This tax credit will be available to you the following tax season after the completed solar system install. Additionally, if your federal income taxes are less than your total tax credit, then the leftover credit will carry over to the next year (for up to 5 years) allowing you to enjoy the maximum savings.

Additional Energy Related Incentives Effected

The OBBBA doesn’t just cut the residential solar tax credit. It also affects other clean energy incentives that had previously been extended or advanced under the IRA:

- Battery Incentives: Currently, homeowners who install battery backup systems along with their solar system can claim the same 30% tax credit across both, however this will disappear as well after December 31, 2025.

- Home Efficiency Upgrades: The Federal tax credit for upgrades such as insulation, windows, HVAC systems, and other energy-efficiency improvements will also be ending based on the bill’s changes.

- Electric Vehicles and EV Charging Stations: With the new bill, customers only have until September 30th, 2025 to claim credits for new or used EV purchases. Tax credits for EV charging stations and associated electrical panel upgrades are also set to sunset.

Why 2025 is the Year to Go Solar

1. 30% Tax Credit Sunsetting

Waiting until 2026 or later to go solar will mean paying thousands more. You’ll be losing the biggest single financial incentive for residential solar. And with financial benefits being one of the top reasons homeowners look to solar, you’ll want to save as much as possible to maximize this.

2. Get Started Now and Beat the 2025 Rush

We’re already seeing a massive spike in contract signing in residential solar since July 4th – and it hasn’t even been a full week since the bill passed. We only expect this surge in demand to continue growing in the coming weeks and months. Increased demand will bring longer wait times as we move towards the end of 2025. Don’t wait and risk scheduling challenges or delays!

The OBBBA creates a very tight deadline for solar. Going solar is a process, like most home improvement projects, and unexpected delays can occur. Get started sooner to account for this possibility and give yourself peace of mind when working with permitting, utility approvals, equipment availability and more that can all bring unexpected delays (4). A study by the National Renewable Energy Laboratory (NREL) shows that it generally takes 70-112 days to get a solar installation fully up and running from signed contract (5). While we often beat these installation timelines at Kasselman Solar, it is imperative to start the process as soon as possible to take into account any possible delays. Don’t let hesitation be the difference between losing thousands in savings.

3. Utility Rates Continue Rising

Electricity prices will only continue increasing in the coming years. Noted by EnergySage, “AI data centers are driving unprecedented electricity demand, with consumption expected to increase 130% by 2030. To meet this demand, utilities are expanding power generation and grid infrastructure – costs that get passed directly to homeowners” (2). New Yorkers are paying some of the highest electricity rates across the country, and many local utility providers have announced continued rate increases this year and beyond. With solar you can lock in a more predictable energy cost and gain energy independence before your bill keeps increasing.

4. Don’t Forget About State and Local Incentives

With Federal incentives sunsetting after this year, it’s important to also look at state level incentives. These can be stacked with Federal incentives for even greater savings – but are also subject to changes or budget limits in the future. Take advantage of New York State’s great incentives while they’re here as well.

Read more about New York State Incentives.

The Bottom Line: The Time to Go Solar is Now

The passing of the One Big Beautiful Bill marks a turning point for clean energy in the U.S. – and an urgent deadline for homeowners. The 30% Federal Solar Tax Credit is ending December 31, 2025, slashing one of the largest incentives for going solar nearly a decade early.

By going solar now, you can:

- Claim 30% of your project cost back in tax credits – potentially saving up to $9,000 or more

- Beat the end-of-year rush and lock in today’s pricing

- Protect yourself from rising utility rates

- Combine current New York State incentives with the 30% tax credit for maximum savings

Get a free solar estimate and schedule a consultation with our team to start saving:

*Kasselman Solar is not a tax advisor. Consult with a tax professional to confirm your eligibility for solar tax credits.

- https://www.govinfo.gov/app/details/BILLS-119hr1rh/summary

- https://www.energysage.com/news/congress-passes-bill-ending-residential-solar-tax-credit/

- https://www.kiplinger.com/taxes/tax-law/homeowners-rush-to-install-solar-panels

- https://www.pv-magazine.com/2025/07/11/what-homeowners-need-to-know-as-us-solar-panel-tax-credits-end/

- https://www.sciencedirect.com/science/article/abs/pii/S0301421521006005